If for example the members of the family provides outgrown your house and requirements more space, you will be thinking: Do you require your Va mortgage double? Luckily, the solution are sure. You can repair your own complete Virtual assistant mortgage entitlement by the promoting your own domestic otherwise paying the borrowed funds completely. Rather, you can use the leftover entitlement count throughout the pick of one’s very first property to order the second home you to definitely ideal suits your needs.

not, there are particular Va financing standards you’ll need to meet to pull out a different financial. We have found a useful, small help guide to all you need to learn about recycling the Virtual assistant financing.

Virtual assistant Financing Entitlement: How it functions

Your entitlement is the amount of money the fresh Va will pay to make sure the loan for folks who default with it. Entitlements basically verify twenty-five% of your amount borrowed, so they eliminate the dependence on a downpayment and private financial insurance.

There have been two different kinds of entitlement which you are able to discover when your qualify for an effective Va financing: earliest and bonus.

- Earliest entitlement covers 25% of your own loan amount or $thirty-six,one hundred thousand, any is actually less. Very first entitlement just applies to fund doing $144,100000, even though. If you want to purchase a top-valued family instead of a downpayment, you will have to utilize their incentive entitlement.

- Incentive entitlements security twenty five% of your amount borrowed towards the one home pick a lot more than $144,100000. There is no higher restrict into cost in your home.

So even though you live-in a costly area, you can easily make use of Virtual assistant mortgage to acquire good beautiful assets for your family.

How to reuse the Va loan work with

short term loans in Moulton AL

Virtual assistant fund is actually a lives work with that you can use in order to upgrade your household as your relatives and want for place develop. When you sell otherwise repay your home, you will get the full entitlement restored and use it in order to pick a much bigger home. If you value to order the second family before attempting to sell your own basic home, you happen to be able to use the leftover entitlement accomplish so. Here is a very detailed check your choice.

Fixing your entitlement immediately after offering

One of the most effective ways in order to reuse your own Virtual assistant loan was to market your family. You need brand new arises from the latest income to settle your own financial in full and ask for that the Virtual assistant Qualifications Center regulates your own entitlement. Both the basic and bonus entitlement is actually reinstated as soon as your paperwork try canned, and you’ll be ready to get an alternative fantasy household having your family.

Making use of your left entitlement

For folks who have not made use of their full entitlement but really, you’re able to take out the second Va mortgage purchasing a special home as opposed to offering your you to. You can find out if you’ve burned up their full entitlement because of the asking for a certificate off eligibility about Va or doing a little math your self.

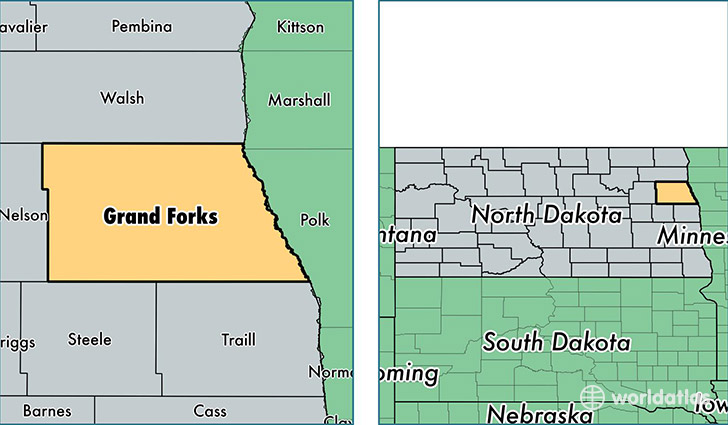

Observe how much of your own entitlement is left, you will have to get the compliant mortgage limitation for the county, you’ll find towards the Va site. Compliant financing restrictions are the restriction mortgage numbers one to regulators organizations for instance the Virtual assistant are able to right back. For each and every condition is actually assigned their mortgage maximum so you can take into account variations regarding cost-of-living, thus more expensive portion will receive highest loan limitations.

The utmost warranty is even an important basis to consider. It will be the number of your own Virtual assistant mortgage which is supported by the Virtual assistant (aka this is the count they’re going to shelter for many who default). That have you to support reduces the chance having lenders, permitting borrowers so you can acquire way more during the greatest prices.

Calculate your own limitation warranty by subtracting this new percentage of the entitlement that you’ve already made use of out-of twenty five% of your compliant mortgage restriction, which is the portion of the loan that Virtual assistant usually be certain that. So, including, if your loan maximum on your county was $510,400, the utmost guaranty you’d qualify for was $127,600. If you have currently utilized $50,one hundred thousand of the entitlement, your restrict guaranty available would-be $77,600. If you want to pick a far more high priced domestic, you will have to cut back getting an advance payment of twenty five% of the amount borrowed that is not included in this new guaranty.

Va financing requirements

- Your brand new home must be a primary household – maybe not a holiday family otherwise leasing possessions.

- You’ll also need certainly to move into your residence within this 60 days shortly after closing.

There are particular exclusions to that particular rule, whether or not. When you’re deployed, working out out of condition, otherwise life style somewhere else when you renovate your home, you could potentially slow down occupancy for approximately 1 year. Your wife or son may meet with the occupancy requisite in the event that you happen to be not able to do so.

We’re here to help

If your nearest and dearest keeps growing, it’s not necessary to stay static in your home. You could potentially recycle the Va loan to get a new household even if you don’t have a deposit saved up. You might promote your current the home of have the full entitlement reinstated, otherwise make use of the leftover add up to help fund the next house buy. All you want to create, i on OVM try here to help you with any queries you may have and direct you through the techniques. Give us a call or begin your application now.

يلا خدمات

يلا خدمات