Brand new Yorkers will not be able to have the advance payment when purchasing a assets into the Nyc. Providing a mortgage actually effortless. Many choices help anybody reach control of an enthusiastic Nyc family. The two most significant inquiries people face when bringing approvals are income therefore the down-payment. Virtual assistant money not one of them a down payment; but not, civilians do not have use of that type of mortgage. Rescuing upwards to possess a down payment isn’t really simple, particularly if you need to upgrade your domestic. According to disease, to buy a connection financing to get a house was an excellent good option.

A link Loan to order a house bridges the new pit between investing. Sellers can use they to shop for a unique family immediately. Their funds try tied up through its house sales, hence consist in the market but has never sold. This mortgage are quick-title. Some vendors also can funds the buyer in the short term. Its visit this site called seller’s financing.

Loan providers expect you’ll get paid back toward assets purchases. Although not, bridge loans bring higher charges and you may rates. Specific regular conditions so you can qualify are experiencing a good credit score and achieving at the very least good 20% collateral in your possessions. Extremely link financing take place in an attractive housing market.

That it loan brings brief financial support to own a house pick since debtor protects expanded-term capital. On New york a house globe, buyers play with link finance locate a deposit ready towards an effective the new property as they wait for profit of one’s own household.

Customers fool around with bridge money to greatly help have the loans must purchase a home, nonetheless they are not a lot of time-title finance. Rather, he could be short-title money that you ought to pay off towards sale in your home comes otherwise within this a year.

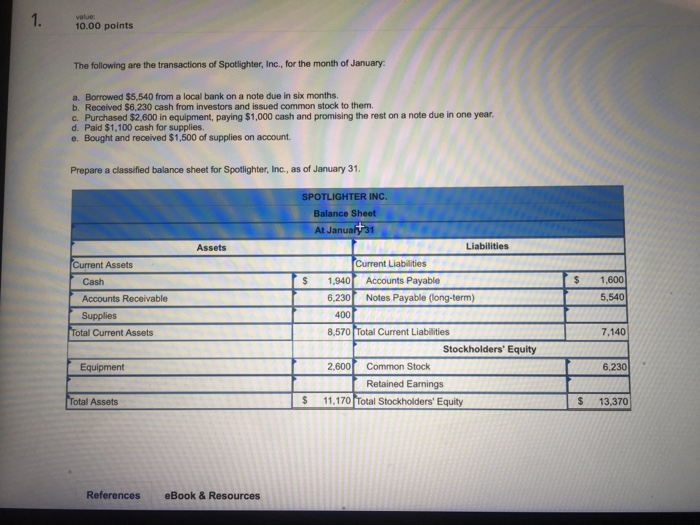

- Score a down payment and you can safeguards closing costs.

- The newest acceptance process is quick, which makes to find a home smaller.

- Specific sellers needs a buyer who’s got a bridge financing over a buyer whom does not.

It hold high-interest rates and large charges. The conditions is actually short, and it’s an infamously expensive station, but it’s a short-label provider.

By using these money merely is sensible while looking buying a assets into the a hot market. You know your property will actually sell and require to go At the earliest opportunity, and are costly and you can a little risky. Yet not, they’re able to sound right if you need an instant a property closure.

Just how can Connection Loans Functions?

- Pay-off your own brand spanking new financial and give you extra cash to have an advance payment to your a separate household. If the household becomes offered, you only pay off the bridge mortgage.

- To manufacture an advance payment for those who have already paid down their home. You need a connection mortgage to find the down payment, and these money are dramatically reduced inside the security.

What the results are should your house is maybe not offering?

Some lenders could possibly get stretch this new words if you can’t see a good consumer contained in this a-year. But not, you pay your own home loan together with connection financing, resulted in a loan default. If you’re not sure your property will actually sell, never aim for a bridge mortgage, that’ll effortlessly backfire.

- About 20% equity of your property.

- Advanced credit. (no less than 720)

- Your residence must be inside a sexy and you can drinking water market.

Which are the Solutions To Link Funds?

- HELOC (Home Equity Lines of credit) – is actually a line of credit centered on your house guarantee. HELOCs bring a much better price, all the way down fees, and you may an extended identity. A good HELOC tend to nevertheless enables you to finance renovations if you never sell your home.

يلا خدمات

يلا خدمات